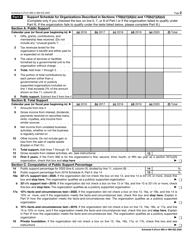

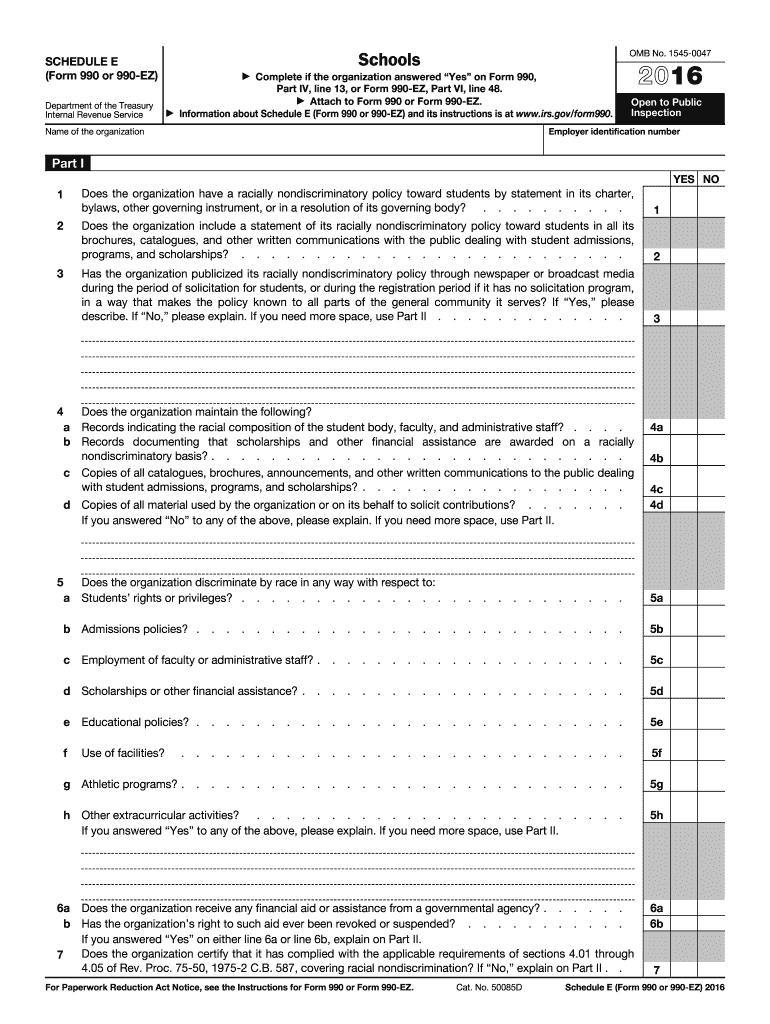

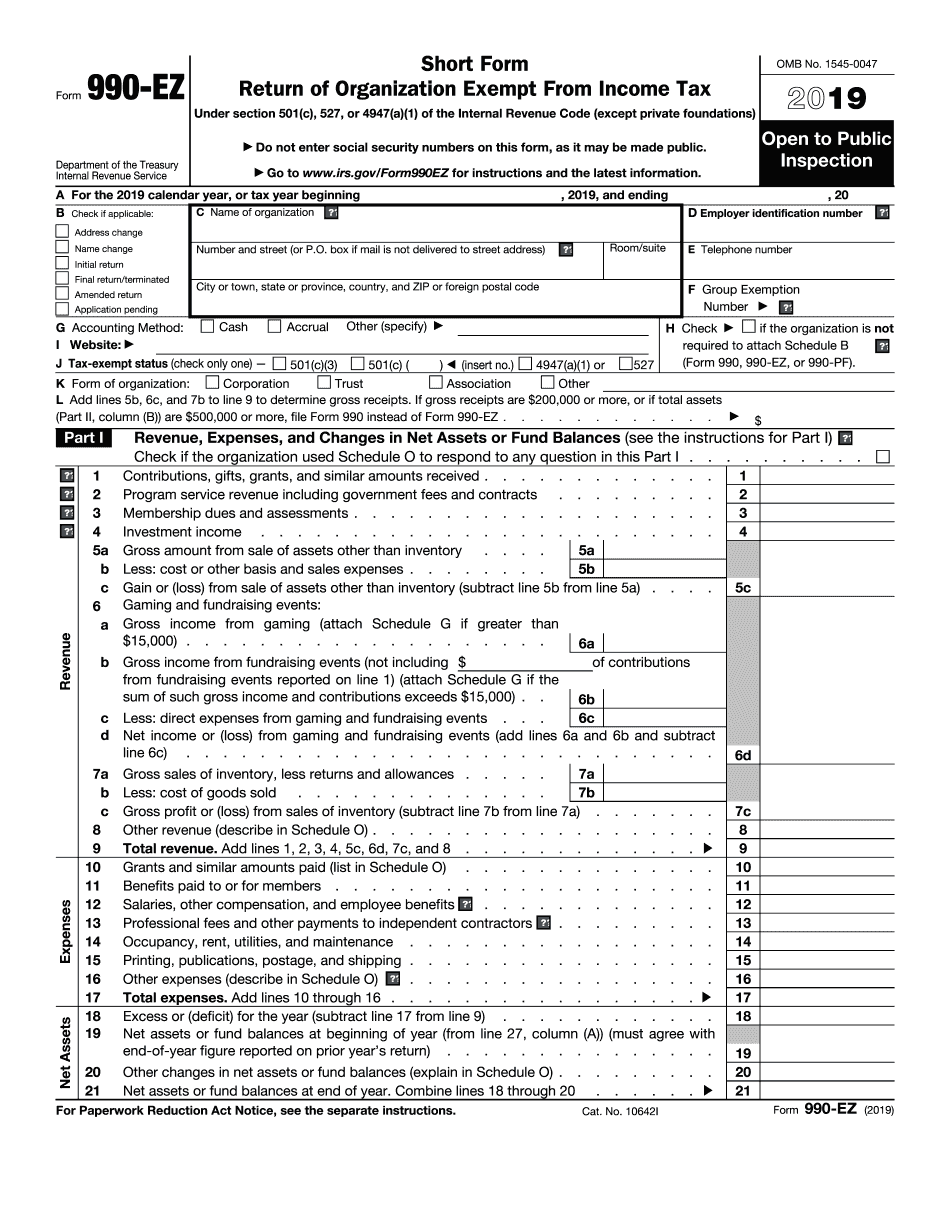

The agency has designed a very convenient advanced e-file system (also referred to as MeF), which allows you to submit the form within seconds and to get the acknowledgment very fast. The tax agency offers you great opportunities to avoid wasting your time on printing and sending paper forms. Once you have filled out the form (see the guide below), you are to file it with the Revenue Service. We encourage you to read the article till the end and act in accordance with our instructions. Having taken into consideration all the issues and questions that might arise, we have prepared a comprehensive guide to the form under discussion. Legal forms, especially tax revenues, may seem rather difficult to complete and submit. Another way of checking is by phoning the agency. If you need to check the status of any company or other foundation, you are allowed to do it online. The tax agency’s official website has information about all tax-exempt organizations. If you want to know whether or not you need to attach Schedule A, check out if you fall under the descriptions in the following sections: Thus, if your answer to the first question of Part 4 in the revenue form is “Yes,” do not forget to attach Schedule A. It is a legal form required to file with IRS along with Form 990 (or 990-EZ) to provide detail about public charity status (if you have been granted one) or public support. One of the essential schedules is schedule A. There exist 16 Schedules for Form 990, which give additional information about organizations reporting their income.

#PDF FORM FILLER 990EZ PROFESSIONAL#

We advise hiring a legal professional who can assist you in completing such a complex form.

For instance, if your total amount of assets exceeds 500,000 USD or the value of gross receipts is more than 200,000 US dollars, choose Form 990. Which type you need depends on the gross amount of assets and the value of gross receipts. If you meet the requirements under section 501(a) for tax-exempt organizations, be ready to file one of the above-mentioned forms.

They reveal the information about financial details and activities (expenses, assets, etc) and supported organizations.

#PDF FORM FILLER 990EZ FREE#

Even if your entity is free from paying federal, state, or local taxes (in other words, tax-exempt), you must report information about your income and financial transactions each year. The Internal Revenue Service (also known as the IRS) is the agency that controls the financial activities of all types of organizations regardless of their status. Landlord (Tenant) Recommendation Letter.

0 kommentar(er)

0 kommentar(er)